operator vision

Hospitals and Rehabilitation Centres

is people

people and planet

Hospitals and Rehabilitation Centres

operator vision

people and planet

is people

Healthcare Activos

Focused

on Real Estate Investment

in the Healthcare Sector

at European Level.

We believe in the virtuous circle of health.

Few investments are so positive for people, the sector, society and the planet simultaneously. Quality in the health sector is the engine of long-term economic development and social cohesion.

Healthcare Activos was born with the vocation to have a long-term positive impact on both people and the community. We consciously specialize in the health sector because this allows us to improve people’s lives with each of our daily actions.

Seeking the best for current and future patients, and for society is the basis of our strategy.

Strong commitment to sustainability

We are leaders

Referral partner

in the long term for the

large Healthcare operators.

Healthcare Activos is a recognised leader in the development of healthcare infrastructure, a partner of the largest European groups in the sector.

Positioning the Patient

at the Healthcare

Services Center.

We care about people in all their dimensions: as

service users, such as professionals and investors, such as

citizens and, ultimately, as inhabitants of a planet

that we have an obligation to protect.

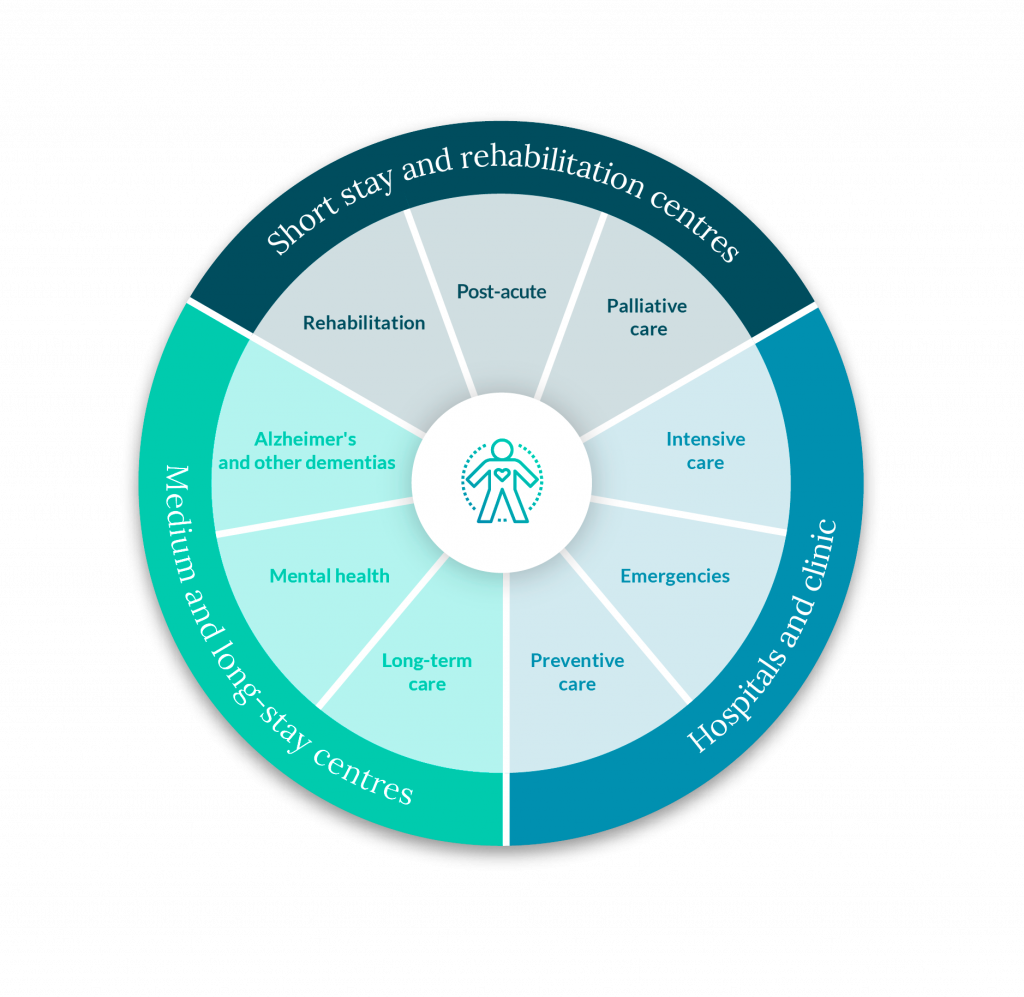

We have a unique and joint vision of the sector, which does not distinguish between the health and the social, but rather places the person at the center, as the axis on which the services must pivot.

Achieving the best for the user entails the best results for society and for investors.

Our Trajectory

Main Figures.

630m

euros in value

of assets

50

Number of assets

1.9x

Coverage ratio of

average rent

19

WAULT of the portfolio

(years)

Sustainability

Social impact

of Healthcare Activos

Environment

Social

Governance

The objectives pursue equality between PEOPLE, protect the PLANET and

ensure PROSPERITY as part of a new development agenda

overall sustainable.

European operators

First Level